Adilon Fundon was born out of a simple yet powerful idea: to widen access to investment education. Recognizing the gap between financial literacy and accessibility, Adilon Fundon was created to connect those interested to suitable investment education firms.

With a mission to make investment education more accessible, Adilon Fundon established a welcoming space for the average person. Adilon Fundon connects users with suitable investment education tutors who offer diverse courses to beginners and people at more advanced levels.

Adilon Fundon connects registered persons to investment education firms that share the same vision of equipping more people with financial knowledge and skills. Want to be a part? Register on the website for free.

Adilon Fundon was founded on the idea of creating a connection. We link individuals with investment education institutions, helping them learn all they need to make informed financial decisions.

At Adilon Fundon, anyone can get linked to investment education firms with no cost attached. Adilon Fundon helps bridge the gap between its registered users and firms where they can explore educational options for free.

Whether one is a newbie or a seasoned professional, Adilon Fundon sets them up with suitable educators who can train and equip them with skills in making informed financial decisions.

Accessing investment information quickly on the internet can be challenging. People often spend long hours online trying to gather the required information. What’s more? Said information may be overwhelming and leaves people more confused than ever. Adilon Fundon changes this experience.

Understanding the value of time, Adilon Fundon provides a simple solution for anyone eager to learn. By registering on the website and following just three steps, anyone can connect with investment education tutors and access comprehensive knowledge about investing.

Adilon Fundon welcomes anyone eager to connect with investment tutors. Simply register on the website by filling in a few details like name, phone number, and email address.

At Adilon Fundon, our primary role is to link people with investment education firms. Adilon Fundon matches people with educators who fit their learning preferences, granting access to suitable educational resources from their assigned tutor.

Once the match has been successfully done, a representative from the investment education firm is expected to reach out. They will guide the induction process, explain how the firm operates, and assist in setting up. It’s free to use Adilon Fundon. Why not sign up?

Think literacy is just confined to what is taught in classrooms? Think again. Financial literacy, often overlooked in school later on, becomes a personal mission for many. It is an essential skill in today’s world. Adilon Fundon has simplified the learning process by serving as a bridge between people interested in learning and investment education firms.

At Adilon Fundon, we have set up a working system to connect these persons to suitable investment education institutes that supply financial knowledge. Looking to learn investing? Let Adilon Fundon lead. It’s free!

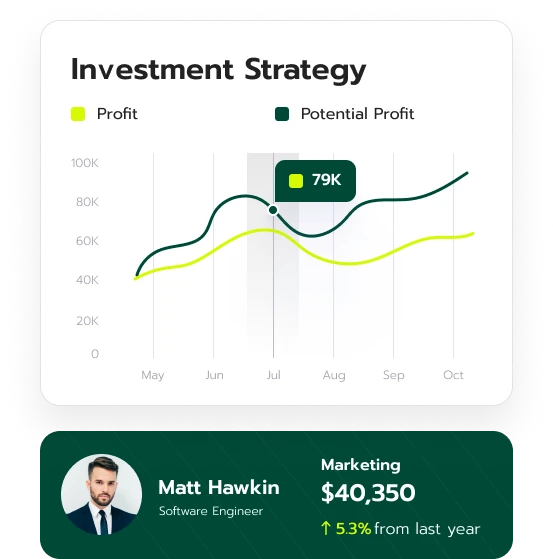

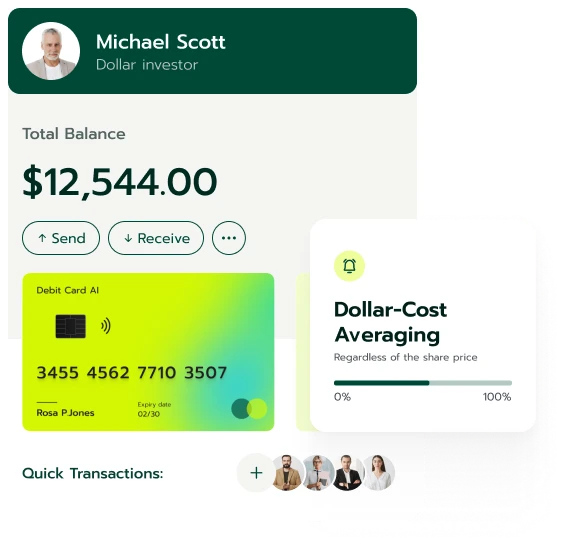

Dollar-cost averaging (DCA) is quite simple and easy, although it might sound complex. It is a strategy that has roots in consistent, everyday habits. This method involves regularly investing a fixed amount in the market, no matter what the prevailing conditions.

DCA works across different asset classes, from equities to bonds to commodities and beyond. Want to learn more about this approach? Sign up on Adilon Fundon.

Dollar-cost averaging may help to reduce the impact of market volatility over time, as it averages out the cost of the investments. By doing so, investors may buy more when prices are low and less when prices are high, which could help smooth out the highs and lows over time.

Compound interest is a process where the interest earned on an investment is reinvested to try and earn more interest. More concepts under compound interest include;

Time Horizon

Early investments allow compound interest to work over a longer period, giving room for more possible accumulation.

Financial Discipline

Compound interest teaches the value of starting early and being consistent. It may discipline financial habits, such as saving regularly and reinvesting.

Debt

Compound interest also applies to debt. If debts are left unpaid or unattended, it can go out of control.

Understanding how compound interest works on loans is very important for managing debts. Register on Adilon Fundon to find out more.

A common misconception many have about investment is the idea of getting rich quickly. Many believe that investing leads to immediate wealth without considering the time required and the risks involved. Being patient and consistently adapting to different market conditions may help investors brave the investment world. Thanks to Adilon Fundon, anyone can learn from investment educators about strategies and approaches to address the challenges they may face.

Events like economic policy changes, geopolitical developments, and natural disasters have significant impact on financial markets. Understanding how these events affect the market helps investors anticipate possible impacts on their investments.

Tension between countries might affect trading policies, influencing companies to get involved in international trade. Understanding the short-term and long-term effects of such events is essential for investors.

Additionally, global events can disturb supply chains, affecting the availability and cost of goods as it can lead to shortages in important materials or commodities, which can affect the company’s operations. In the investment world, how much knowledge is available and how the knowledge gained is applied is crucial. Adilon Fundon serves as a connecting link between investment enthusiasts and suitable investment education institutes.

Dollar-cost Averaging involves several practical techniques designed to simplify investment strategies. One of the fundamental techniques is consistency in investing a fixed amount at regular intervals, regardless of what the market says. For instance, an investor might contribute a set amount each month to a mutual fund.

The essence of this methodology is straightforward. By spreading investments over time, DCA helps to eliminate the stress of trying to time the market. Here are some other techniques associated with DCA:

Lump-sum conversion is a cut-to-the-chase method where a substantial amount is invested all at once rather than gradually over time. This method is often used by companies and individuals with noteworthy funds to allocate. They also aim to capitalize on market opportunities. Want to know more? Adilon Fundon connects people willing to learn to investment educators.

In this technique, the amount invested is adjusted based on changes in financial goals or market conditions while maintaining the fixed investment amount, which is done periodically. It could help in systematically locking in gains from asset classes that may have performed well. Adilon Fundon points to more insight into this concept. Register for free.

Some investors set up automatic transfers or contributions to accounts for investment purposes. The idea is to invest consistently without needing to execute trades or conduct transactions manually.

Various asset classes or investment vehicles are invested in fixed amounts based on a predefined allocation plan for diversification and managing achievement. Register on Adilon Fundon to connect to knowledge on this.

One of the most important concepts to understand when creating a portfolio is asset correlation. It’s a mathematical measure that shows how two or more assets move in alignment with each other. It is used to determine whether different assets tend to rise and fall in sync or independently of one another. Understanding this is essential as it helps build a portfolio that could balance risk. Use Adilon Fundon and set up to learn much more about this.

By reducing assets with low or negative correlation, investors may reduce the volatility in their portfolios. Investors often use a correlation matrix to assess the relationships between multiple assets.

How does the average dollar cost (DCA) compare with lump sum investing? Both strategies provide unique plans for managing investments, but they cater to different needs and preferences. While DCA is all about a fixed amount of finance at regular intervals and consistency, lump sum investing involves putting a large amount of capital into the market all at once.

While both approaches are designed to try to seek capital gains, they still differ in their approach to risk management and market timing.

Lump sum investing, while being the riskier option, may yield returns when investors execute them during favorable market conditions. However, there is also the risk of timing the market poorly, which can lead to significant losses if the market moves against the investment shortly after. Interesting, right? Sign up on Adilon Fundon to learn more.

DCA is driven mainly by its ability to mitigate investment risks and navigate market volatility. During periods of high volatility, sticking to one’s DCA plan may be advisable. Pulling out during downturns may lock in losses and prevent one from possible gains if the market recovers. For more knowledge about this and the training to pilot this world of investment, go for suitable education. Register on Adilon Fundon and get connected to learning from suitable educational firms.

A credit risk model is a financial tool to assess the possibility that a borrower will default on their debt obligations. It helps lenders and investors determine how creditworthy an individual or a business is.

This is referred to as the process of determining the fair value or theoretical price of an option. It is an advanced area of financial mathematics that involves several vital concepts and models. Sign up on Adilon Fundon and connect with tutors who’ll break down this concept.

It helps businesses optimize their inventory levels to balance supply and demand. Economic order quantity and ABC analysis can also be found in the key models of inventory management. Learn all about these after registering on Adilon Fundon.

This analyzes how different prices or variables impact a model of financial outcomes based on historical data, assumptions, and trends.

This analysis model determines the sales volume and price at which total revenues are equal to total costs, indicating the stage of no profit or loss.

A budgeting model assists organizations and individuals to plan and manage their financial resources. It also monitors actual performance against the budget to manage.

Like any investment strategy, dollar-cost averaging (DCA) has its limitations in the financial sector. To truly understand how investment and other financial terms work, training and lots of research is needed. Adilon Fundon comes to full play here by providing one of the fastest ways to learn. Adilon Fundon connects people to investment education firms that provide the necessary training. Register to get started!

| 🤖 Registration Fee | Zero cost to register |

| 💰 Administrative Fees | Fee-free service |

| 📋 Enrollment Ease | Simple, quick setup |

| 📊 Study Focus | Insights into Digital Currencies, Forex, and Investment Funds |

| 🌎 Country Availability | Available in nearly every country except the US |